Category: Judge Information

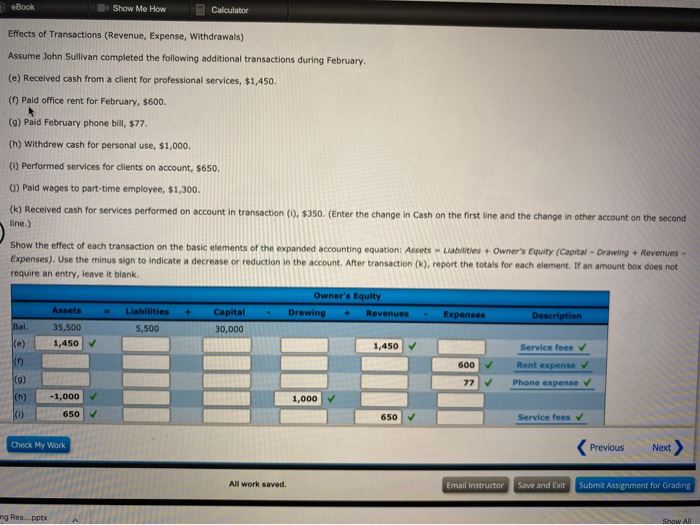

Regrettably, particular borrowers exactly who paid down their mortgages early statement they certainly were billed a whole lot more focus on benefits than simply they must have acquired in order to payperhaps in the ticket out of government regulations.

Of a lot ?ndividuals are interested in though Regions Lender offers FHA money. FHA finance are provided by the personal lenders particularly Places Financial and you will is covered from the Government Property Government. These finance are around for refinance and you may ordered fund and permit to have fixed monthly payments and you will low-down repayments.

Particular consumers might have been negatively impacted by a practice that is utilized by the particular financial institutions whether or not such charge was indeed prohibited once the .

Brand new rule involved is due to HUD and FHA removing blog post commission attract costs. For those who have in the past got a federal Housing Government mortgage when you look at the during the last, or an areas FHA mortgage, and you also prepaid service that financial in full, the newest FHA recognized mortgage lender could have recharged attract through the end of week where last percentage was developed.

Would FHA Money As a consequence of Places Lender Enjoys Prepayment Punishment?

To the , FHA and you will HUD decided to beat one post-fee focus prices for most of the unmarried family relations mortgage loans that are covered of the FHA you to finalized to your or shortly after .

Before the big date the alterations was passed, it had been standard routine to the FHA so that loan providers to charges a full month’s notice while a debtor paid off the latest an excellent balance regardless of what day of the day it was repaid.

It, by-the-way, payday loan lender list was not your situation in other style of mortgage loans. Let me reveal a good example: in the event the a debtor have the mortgage courtesy his or her regional borrowing commitment while the interest portion of the typical month-to-month percentage was $900, one attract commission could be expert-ranked at $31 twenty four hours . For example, whether your financing are paid back on fifteenth of the month, the eye percentage of one payment was $450.

not, which have a keen FHA financing under the old laws, the latest debtor will have must afford the entire $900 essentially amounting so you can a beneficial $450 penalty getting simply having the ability to spend the mortgage of very early.

Into the 2014, the user Monetary Security Bureau (CFPB) figured the newest FHA’s notice fee policy was in citation out of then-most recent Controls Z provisions of your own Facts when you look at the Lending Act out of 1968. This was an amendment into User Cover Act, and you can are intended to cover consumers away from deceptive credit techniques. The fresh CFPB ruled you to pushing a borrower to spend durante whole month’s desire when prepaying financing earlier regarding the times was actually mistaken and you will deceptive hence the latest regulations that were introduced within the .

Sadly, some lenders have failed to find the content, or somehow believe they are able to bypass they. Regardless of the the laws, specific lenders was implicated of persisted so you’re able to charge a full month’s appeal upon rewards of your own financing. Places Financial is actually suspected away from carrying-on so it routine.

What does the fresh Rule Protect to possess Consumers?

The fresh new signal claims you to consumers cannot be recharged pre-fee attention which mortgage lenders need deal with pre-costs in virtually any number and at at any time. Although not, particular users might have been influenced by the brand new charging away from an enthusiastic notice commission when they refinanced, sold or paid off their mortgage over the last couple of age.

A current research is attempting to determine if users just who got an areas FHA mortgage has been affected. Those users who had been charged post-payment attention charges adopting the code ran into the feeling may have reasons behind lawsuit. It will be possible specific banking customers which went with a parts FHA mortgage could have been energized financial interest they shouldn’t have obtained to blow.

What’s an enthusiastic FHA Financing?

FHA loans are just authorities supported mortgages covered because of the Government Houses Government. FHA home loans need reduce costs and lower minimum borrowing scores leading them to very popular one of first time homebuyers.

Predicated on Bankrate, a lot of people is also qualify for an FHA mortgage in just ten % down and you will a credit score only 500. To help you qualify for even more positive words, a borrower need to have a credit score with a minimum of 580 and become waiting which have a good step three.5 per cent deposit.

FHA funds functions flexibly, centered on LendingTree, because the brand new advance payment might be risen to ten percent for these those who have a credit history ranging from 500 and you can 579 and people who features a bankruptcy proceeding within their earlier.

Those individuals people that started influenced by today blocked blog post payment focus charges over the last decade tends to be curious regarding their legal rights to sign up it current studies.