Stop these types of prospective roadblocks anywhere between you and your new set out of tires

If to invest in a new otherwise used car, a lot of people should not buy an automobile downright. If this sounds like your, then you’ll definitely need to safe an auto loan installment loans Golden Gate. However, according to your existing financial predicament, particular loan providers get hesitate to leave you approval.

step 1. Less than perfect credit

Any time you make an application for an auto loan, the lender is going to look at your credit rating. If you’ve generated certain financial missteps in earlier times as well as have less than perfect credit, this might head an assertion.

A few errors that may manage serious wreck, actually so you can a good credit history, was defaulting for the a loan and you will declaring bankruptcy. For folks who defaulted with the a history car loan along with the fresh new vehicle repossessed, it gets more difficult to find recognized for another car mortgage.

Other techniques in terms of your credit rating was your own payment history and you will credit use. Their fee history will suffer if you don’t help make your lowest costs repayments punctually, particularly if you fail to build a charge card payment. The credit use endures for many who constantly use more than thirty % of offered credit.

Neither of these situations often decrease your credit history straight away, but if a poor fee history and higher credit usage feel a regular situation, your borrowing from the bank are affected.

2. Not enough Credit score

Your credit rating was a sign of their creditworthiness. For people who haven’t founded one credit history, it is nearly because problematic because the with a less than perfect credit rating.

For people who haven’t obtained one funds or credit cards regarding the early in the day, then chances are you age. Loan providers could well be cautious with issuing your a car loan because you haven’t proven that you could become leading to invest straight back the money you borrow.

Luckily it is easier to expose credit than just its to correct it. Of the getting, using and you will faithfully paying credit cards, you’ll be able to rapidly enhance your credit score.

step 3. Earnings Items

Have you ever good credit, nevertheless usually do not make enough money to settle your car loan. Within condition, the car financial get prefer never to agree the loan.

Exactly what loan providers typically check is actually their month-to-month earnings and your debt-to-income ratio. Along with your month-to-month earnings, it examine extent you will be making having simply how much your car or truck financing payment could well be. To suit your debt-to-money proportion, they appear in the how much cash you may have with debt payments for every few days compared to how much you create.

This type of situations commonly a way of measuring even when you will be a premier earner. If you find yourself the lowest earner with couples expenditures and you may lowest debt, you might nevertheless discovered acceptance into a car loan. On top of that, if you’re a high earner nevertheless already have some an excellent few expenses to blow, a loan provider you are going to refuse your application.

4. Destroyed Documentation

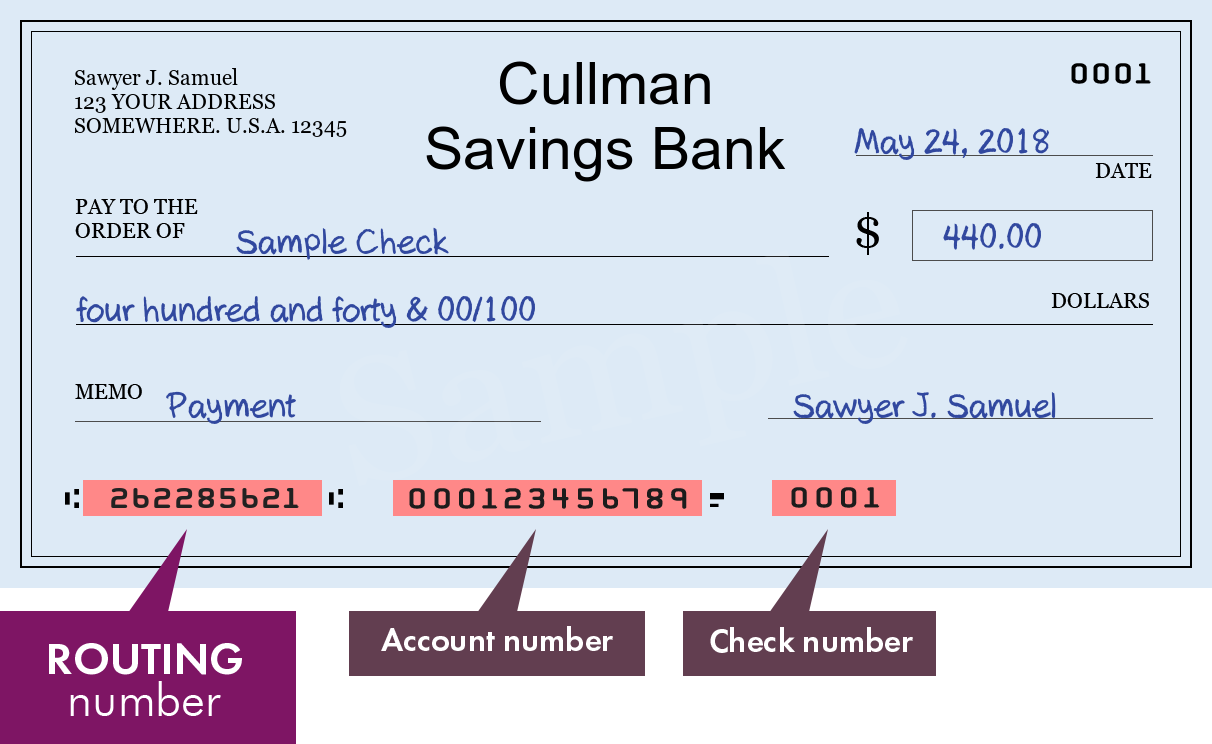

Among the many easiest issues to quit try neglecting to provide the desired data along with your loan application. You may have to tend to be duplicates from spend stubs given that evidence of income, the driver’s license or other files when you apply for a great financing.

More individuals rating rejected for this than you may think, and it’s really a smart idea to double check that you’ve incorporated what you before you can submit the job.

Just how to Get a car loan

From the Bryant Motors, we know just how difficult it may be to track down car financing, and you may all of our purpose will be to permit individuals so you’re able to rating an auto loan. We can help you safe an auto loan even if you have not based their credit yet , or you has poor credit.